pantogormaz.ru

Overview

Natuzzi Editions Quality

Natuzzi Editions Overview · Natuzzi Editions has star rating based on 8 customer reviews. · Rating Distribution · Pros: Good design, Leather, Look and feel. Every model is designed in Italy, in the Natuzzi Style Centre. Designers Furniture is proud to be a dealer of Natuzzi Editions. Natuzzi works hard to. The quality is in the skilled hands of our craftsmen. Unique experience and extraordinary know-how sown and harvested over 60 years of history. Natuzzi Editions products are known for terrific styling and the highest quality leathers--all at a terrific price. Truly, the value presented by. Quality You Can Trust. When you choose Natuzzi Editions, you're looking for a great value as well as outstanding quality. Natuzzi Editions Quality Leather. Terrible quality and rude customer service. Don't waste your money We spent close to $ Waited more than 6 months for 3 seated leather sofa and an arm. There was a very persuasive sales rep working who really sold this sofa to us. When you google Natuzzi Ireland you'll see they have a rating. Natuzzi Editions, a brand of the Natuzzi Group, is known for its soft Italian leather and great value. The designers at Natuzzi Editions create remarkable. Our Italian furniture is made to the highest standards, with a focus on quality and style that will last for years. We offer a wide range of furniture to suit. Natuzzi Editions Overview · Natuzzi Editions has star rating based on 8 customer reviews. · Rating Distribution · Pros: Good design, Leather, Look and feel. Every model is designed in Italy, in the Natuzzi Style Centre. Designers Furniture is proud to be a dealer of Natuzzi Editions. Natuzzi works hard to. The quality is in the skilled hands of our craftsmen. Unique experience and extraordinary know-how sown and harvested over 60 years of history. Natuzzi Editions products are known for terrific styling and the highest quality leathers--all at a terrific price. Truly, the value presented by. Quality You Can Trust. When you choose Natuzzi Editions, you're looking for a great value as well as outstanding quality. Natuzzi Editions Quality Leather. Terrible quality and rude customer service. Don't waste your money We spent close to $ Waited more than 6 months for 3 seated leather sofa and an arm. There was a very persuasive sales rep working who really sold this sofa to us. When you google Natuzzi Ireland you'll see they have a rating. Natuzzi Editions, a brand of the Natuzzi Group, is known for its soft Italian leather and great value. The designers at Natuzzi Editions create remarkable. Our Italian furniture is made to the highest standards, with a focus on quality and style that will last for years. We offer a wide range of furniture to suit.

Natuzzi Italia blends design, functions, materials and colors to create harmonious living. We are devoted to harmony. A stylish sofa—crafted with high-quality Italian leather—belongs in more than just the family room. From dens to bedroom sitting areas, Natuzzi Italian leather. Natuzzi Italia is the world's best known furniture brand, designing sofas, chairs, tables, beds and more to create harmony throughout the home. Natuzzi Editions' are revolutionary manufacturers of high-quality leather sofas. Focusing on the key values of comfort and craftsmanship the Editions. However, Natuzzi Editions is made with the same premium quality % top-grain leather as other Natuzzi product lines. Additionally, every Natuzzi Editions. When it comes to leather, Natuzzi chooses only the best. They apply proprietary formulas to improve the softness and quality of the leather to achieve absolute. Natuzzi LeMans 15 leathers main attraction is a lovely soft smooth touch. Some natural features like scars, vein, insect bites can be expected and normal for. A Natuzzi Editions sofa is designed to bring absolute comfort into your life, thanks to the high quality guaranteed by a Group founded back in and. A Natuzzi Editions sofa is designed to bring comfort into life. The quality is in the skilled hands of the craftsmen. Unique experience and extraordinary. It is very comfortable, and a good quality piece of furniture. They delivered it into the room of my choice. I unpacked it, and put the legs on. I am very very. Natuzzi fabrics are safe, ecological and OEKO-TEX® Standard certified, guarantee of total fiber-and-textile-product sustainability. smart premium. The couch has served us well and, now that it was repaired to manufacturers standards, should last. Expensive leather couches should last for a long time and. One of the signature products of the Natuzzi Italia brand is the Natuzzi leather sofa. These sofas are made with high-quality leather that is. Looking for luxurious, high-end seating? Natuzzi furniture has long set the standard for quality and meticulous design. Click here to shop our collection! Product Description: Padded track arms, three over three styling, and luxurious large Italian leather seating areas make this Natuzzi Editions model perfect. I bought a white leather sectional from Natuzzi Editions in March 1. The quality of the leather is excellent and expected from a Natuzzi brand sofa. Natuzzi is % high-grade genuine leather. If you have kids or pets, you may prefer Protecta Leather, which has been treated with a protective finish. This. This kind of product is popular but doesn't always come with quality. That's where Natuzzi Editions stands out and impresses. The products you'll find from. Famous for its innovative designs and technologies, NATUZZI Editions presents really awesome choice of sectional sofas, sleeper sofas, sofa-beds, recliners –. If you want a high quality long lasting piece of furniture that is reasonably priced, then Natuzzi is the brand for you! They combine beautiful Italian design.

What Happens To Equity When Refinancing

Home equity loans can be a less expensive option for consumers who need access to cash, while refinancing may be a way to lower monthly payments or save money. If you get the house, what happens next? Are you buying out your partner? What happens to shared earned equity? How will you manage mortgage payments? Can. Consolidate your debt You can use this cash to help pay off your debts. You need at least 20% equity in your home for a cash-out refinance. What is your home equity? Equity is the difference between the current market value of your property and the amount remaining on your home loan. As you pay. Refinancing your home, getting a second mortgage, taking out a home equity If this happens, you could talk with your lender and try to restore your. This type of consolidation allows you to take out a new mortgage equal to the amount you owe on your old home loan plus some or all of your home equity. Your. The amount of money you can borrow by refinancing is up to 80% of the equity you have in your home, subject to any additional charges. Frequently Asked. If you're still in need of cash, refinancing gives you the opportunity to increase the loan amount, if you have the equity to do so. How To Prepare For. Cash-out refinance gives you a lump sum when you close your refinance loan. The loan proceeds are first used to pay off your existing mortgage(s), including. Home equity loans can be a less expensive option for consumers who need access to cash, while refinancing may be a way to lower monthly payments or save money. If you get the house, what happens next? Are you buying out your partner? What happens to shared earned equity? How will you manage mortgage payments? Can. Consolidate your debt You can use this cash to help pay off your debts. You need at least 20% equity in your home for a cash-out refinance. What is your home equity? Equity is the difference between the current market value of your property and the amount remaining on your home loan. As you pay. Refinancing your home, getting a second mortgage, taking out a home equity If this happens, you could talk with your lender and try to restore your. This type of consolidation allows you to take out a new mortgage equal to the amount you owe on your old home loan plus some or all of your home equity. Your. The amount of money you can borrow by refinancing is up to 80% of the equity you have in your home, subject to any additional charges. Frequently Asked. If you're still in need of cash, refinancing gives you the opportunity to increase the loan amount, if you have the equity to do so. How To Prepare For. Cash-out refinance gives you a lump sum when you close your refinance loan. The loan proceeds are first used to pay off your existing mortgage(s), including.

You usually need to have at least 20% in home equity to refinance. Refinancing can also give you an opportunity to get rid of a mortgage insurance premium (MIP). Visit to compare mortgage cash out refinancing vs a home equity loan or line of credit and see which financing options is best for you, from TD Bank. When it comes to mortgage interest, the IRS treats HELOCs and home equity loans in a way similar to how they treat cash-out refinancing. If you use the money. Remember, refinancing doesn't eliminate your debt, but it can lower your monthly payments, give you cash from your home's equity, reduce the term of your loan. You refinance the principal you still owe. You will not get cash from your equity until you sell the house for the price it's worth. However, not having enough equity in your home can make refinancing risky, especially if you do plan to take out home equity loans. Most lenders want you to. Refinancing is often not required to stop paying PMI, however. You can request your lender remove PMI payments from your mortgage bill once your home equity. Cash-out refinancing is when you leverage your home's equity to borrow more money than is owed on your existing mortgage and receive the difference in cash. You. A cash-out refi provides you with a lump sum of cash and the predictability of fixed interest rates. In contrast, a home equity line of credit experiences. As an example, a borrower refinances a loan with a balance of $, and takes out $75, in equity to pay down credit card debt. Due to the fact that. If your appraisal comes back lower than expected, you may not qualify to borrow as much home equity as you'd hoped. 3. Your lender finalizes your cash-out. What happens to your loan balance over time? Cash-out refinance. A homeowner who has equity in their home and who has. At the same time, you might want to improve your credit score. However, you may not have the cash on hand to do it. If so, you may want to consider refinancing. By refinancing your existing home loan, you can gain access to your home equity. You could then use this equity as a deposit to purchase another property to use. A home equity loan allows you to tap into the equity of your home while leaving your current mortgage in place. To do this, most lenders will require you to. How to request a larger credit limit; How to transfer funds to consolidate debt; What happens to your account at the end of your draw period. Need more buying. The amount of money you can borrow by refinancing is up to 80% of the equity you have in your home, subject to any additional charges. Frequently Asked. Cash-out refinance. Access equity in your home by refinancing your existing mortgage and rolling it into a new, larger loan. At closing, your lender will issue. Option to deduct your interest payments: To do so, the itemized deductions on your tax returns will need to exceed the standard deduction, and you must use the. It's possible to lose equity when you refinance if you use part of your loan amount to pay for closing costs. These days, with home values at record highs, most.

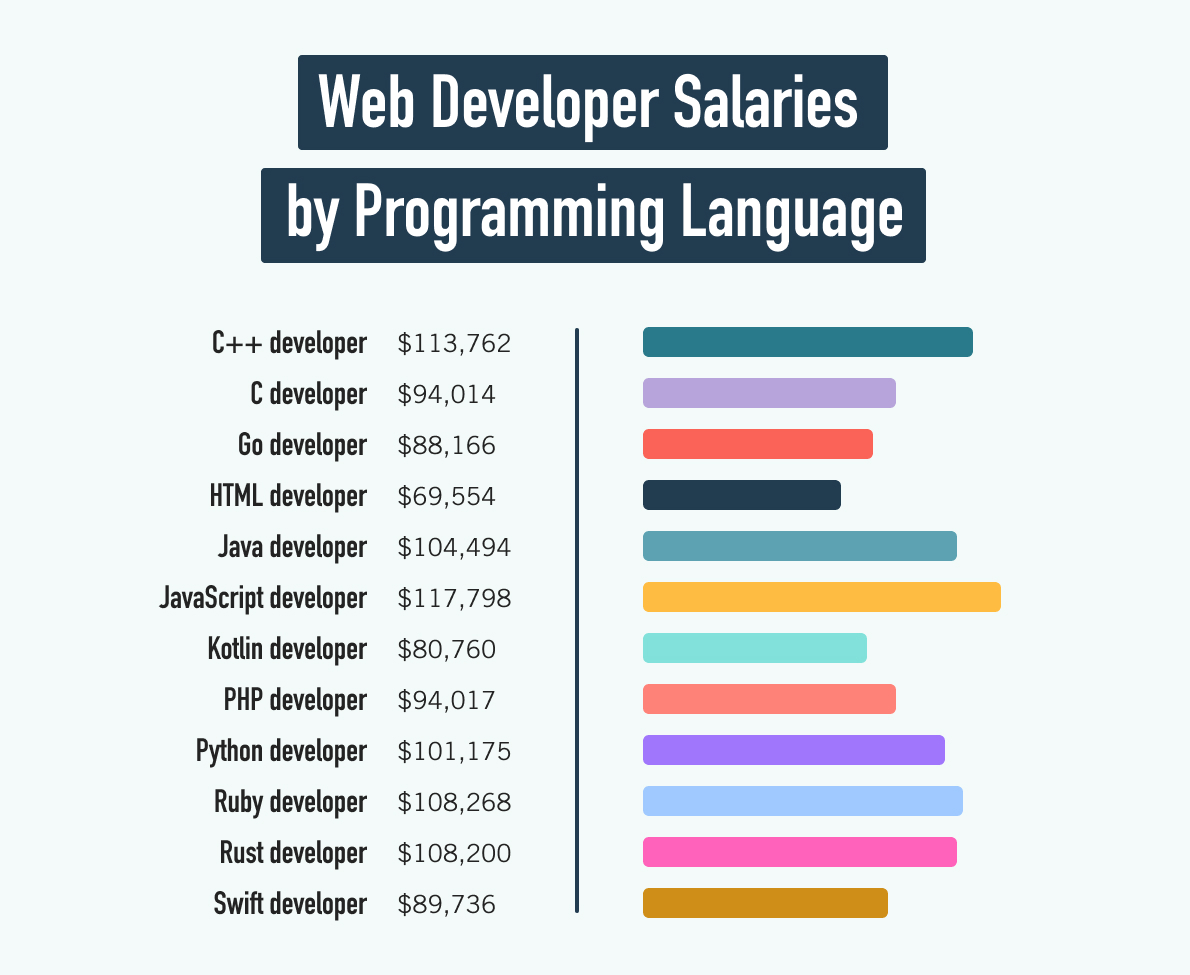

Web Developer Entry Salary

The average salary for. Front End Developer Salary ranges. The most common Front End Developer salary in New York is between. The average salary for a Front End Developer in Austin is $, The average additional cash compensation for a Front End Developer in Austin is $9, The. The avg ENTRY LEVEL FRONT END WEB DEVELOPER SALARY in New York City, NY, as of Jul , is $ an hour or $ per year. Get paid what you're worth! What Is The Average Salary of a Web Developer in the USA? ; Glassdoor (per year), Indeed (per year) ; Junior web developer salary, $70,, $56, ; Median web. The median hourly rate for Web Developers is $ Hourly rates for Web Developers on Upwork typically range between $15 and $ An entry-level self-taught developer salary could be less than $40, per year. Pursuing an advanced degree or a specialized certification can increase. The base salary for Web Developer ranges from $94, to $, with the average base salary of $, The total cash compensation, which includes base. The average annual Entry Level Salary for Entry Level Web Developer is estimated to be approximately $ per year. The majority pay is between $ to. The average junior web developer salary in New York is $67, per year or $ per hour. Entry level positions start at $62, per year while most. The average salary for. Front End Developer Salary ranges. The most common Front End Developer salary in New York is between. The average salary for a Front End Developer in Austin is $, The average additional cash compensation for a Front End Developer in Austin is $9, The. The avg ENTRY LEVEL FRONT END WEB DEVELOPER SALARY in New York City, NY, as of Jul , is $ an hour or $ per year. Get paid what you're worth! What Is The Average Salary of a Web Developer in the USA? ; Glassdoor (per year), Indeed (per year) ; Junior web developer salary, $70,, $56, ; Median web. The median hourly rate for Web Developers is $ Hourly rates for Web Developers on Upwork typically range between $15 and $ An entry-level self-taught developer salary could be less than $40, per year. Pursuing an advanced degree or a specialized certification can increase. The base salary for Web Developer ranges from $94, to $, with the average base salary of $, The total cash compensation, which includes base. The average annual Entry Level Salary for Entry Level Web Developer is estimated to be approximately $ per year. The majority pay is between $ to. The average junior web developer salary in New York is $67, per year or $ per hour. Entry level positions start at $62, per year while most.

The average Web Developer salary is $93, as of July 29, , but the salary range typically falls between $81, and $, Salary ranges can vary. The average web developer salary in the United States is $78, Web developer salaries typically range between $60, and $, yearly. Remote Web developer salaries sit at a global average of $70,USD per year (based on self-reported data). This estimated average salary is based on the. According to the US Bureau of Labor Statistics, in , a web developer's salary on average was $78, per year. Glassdoor shows that a web Developer earns. $75k, big city in Texas, entry level C#/pantogormaz.ru web developer. Every paid to learn from seasoned developers. Upvote 4. Downvote. The average Google Junior Web Developer earns $, annually, which includes a base salary of $, with a $34, bonus. This total compensation is. pantogormaz.ru estimates that, on average, an entry-level web developer salary should vary around the mark of $19,7 per hour (as of January ). With some quick. As of Feb 23, , the average hourly pay for a Web Developer in the United States is $ an hour. Web developers earn an average yearly salary of $70, Wages typically start from $40, and go up to $, 11% above national average ○ Updated in The median salary for a web developer in the United States was approximately $78, per year in Entry-level developers earn between $51, and $74, The average salary for a Entry Level Web Developer is $ per year in United States. Learn about salaries, benefits, salary satisfaction and where you. The average salary for a Web Developer is $ in Visit PayScale to research web developer salaries by city, experience, skill, employer and more. If you're a front end developer who wants to earn more, picking up React expertise, for example, can increase your pay to $, on average. Discrimination. According to the Bureau of Labor Statistics, as of May , web developers in California earn an average annual wage of $, This figure stands. National estimates for Web Developers: ; Hourly Wage, $ , $ , $ , $ ; Annual Wage (2), $ 46,, $ 61,, $ 84,, $ , The average salary for a Junior Web Developer in US is $ Learn more about additional compensation, pay by gender and years of experience for Junior. The average web developer gross salary in United States is $, or an equivalent hourly rate of $ In addition, they earn an average bonus of $4, The average salary for a Front End Developer in Boston is $, The average additional cash compensation for a Front End Developer in Boston is $12, The. The average junior web developer salary in the United States is $65, Junior web developer salaries typically range between $48, and $88, yearly. Web Developers make an average of $ / year in USA, or $ / hr. Try pantogormaz.ru's salary tool and access the data you need.

Debit Card Foreign Currency

Use the converter below to get an indication of the rate you may receive when using your Visa card to pay while traveling internationally. Even where your bank does not have a specific ATM fee, you'll usually pay an additional 'conversion fee' of between % of the transaction. It's an unfortunate. We recommend carrying at least two means of payment: first, a combination of credit, debit, and ATM cards; and second, foreign currency cash to pay for taxis. To see the top options for international use, check out WalletHub's recommendations for the best Visa credit cards with no foreign transaction fees below. Stanford FCU credit and debit cards have NO foreign transaction fees—this is great for international travelers! There is also no card replacement fee. If you use your debit card abroad or pay in a currency that's not sterling, we'll charge you a % non-sterling transaction fee. ATMs will also have a fee for foreign currency withdrawal and using an out of network ATM. Every credit card and debit card I have has no. You can avoid all transaction fees by paying for your purchases in cash while you're abroad. Banks and currency exchange stores will exchange US dollars for. There are no foreign transaction fees with the following products: TD First ClassSM Visa Signature® Credit Card and with TD Bank Debit Cards linked to the. Use the converter below to get an indication of the rate you may receive when using your Visa card to pay while traveling internationally. Even where your bank does not have a specific ATM fee, you'll usually pay an additional 'conversion fee' of between % of the transaction. It's an unfortunate. We recommend carrying at least two means of payment: first, a combination of credit, debit, and ATM cards; and second, foreign currency cash to pay for taxis. To see the top options for international use, check out WalletHub's recommendations for the best Visa credit cards with no foreign transaction fees below. Stanford FCU credit and debit cards have NO foreign transaction fees—this is great for international travelers! There is also no card replacement fee. If you use your debit card abroad or pay in a currency that's not sterling, we'll charge you a % non-sterling transaction fee. ATMs will also have a fee for foreign currency withdrawal and using an out of network ATM. Every credit card and debit card I have has no. You can avoid all transaction fees by paying for your purchases in cash while you're abroad. Banks and currency exchange stores will exchange US dollars for. There are no foreign transaction fees with the following products: TD First ClassSM Visa Signature® Credit Card and with TD Bank Debit Cards linked to the.

ATMs are the best way to access money abroad and are increasingly available. Your bank or credit card company may charge fees for withdrawals overseas. Your bank may or may not use Mastercard currency conversion rates to bill you and may impose additional fees in connection with foreign currency transactions. Yes, credit card companies automatically convert foreign currencies to the domestic currency using their exchange rate. When you look at your card statement. When you choose to pay in the currency of the country or region you're in, Visa or MasterCard will set the exchange rate. Your bank may charge a fee to carry. A Bank of America International Transaction Fee of 3% will apply when converting your currency • If you have any issues with your cards while traveling. Your bank will charge you and most likely the merchant too. Always pay in the country's currency when using a card. Should give you the option. If the fees apply to your card, you'll pay them on every transaction you make in a foreign currency. Fees for debit cards. If you can't view the whole table. Fees will apply when using your credit card at any ATM to perform a cash advance or when using a credit card to withdraw cash. See the Deposit Account Rules &. Many credit cards charge a foreign transaction fee—typically 2% to 3%—on every international purchase. And every trip to the ATM may also incur a fee. That means no credit card surcharges, ATM fees, transaction fees, foreign transaction fees (Footnote), monthly fees, or inactivity fees. Other banks or. A foreign transaction fee (pass-through of surcharge from Visa®) applies when using a BFSFCU debit card at any merchant or retailer outside of the U.S. and is. With a Global Money Account you can order a multi-currency Global Money debit card to use at home and abroad. You can add the card to your digital wallet. Carrying a blend of cash, foreign currency and credit or debit cards adds safety and convenience — but it has to be the right combination for you and your. We won't charge a fee for currency conversion or any other debit card fees on transactions or withdrawals at home or abroad where a Silver, Gold, Platinum and. You can usually get a decent exchange rate by using your debit card in a foreign ATM. However, if you're ever asked whether you'd like to pay in the local. International Service Assessment Fee (ISA): 1% of the amount withdrawn, which Visa charges to help cover currency conversion costs; ATM access fee: most ATM. Pay on card or withdraw cash abroad anywhere, with no fees from us. International payment notification. Great rates. We pass Mastercard's real exchange rate. A foreign transaction fee is a charge applied to a credit or debit card on all international purchases. The charge is usually a small percentage — such as 1% —. If you open an account at Fidelity or Schwab, you can get a debit card with no ATM fees. They reimburse the ATM fees worldwide. The local ATMs. Debit card: Use this at ATMs to withdraw a small amount of local cash. Wait until you arrive to get local currency (European airports have plenty of ATMs); if.

Does Emergen C Expire

Product information ; out of 5 stars 81,Reviews · # in Health & Household (See Top in Health & Household). #1 in Vitamin C Supplements. #28 in Sales. I understand how it can challenging for companies to produce products with more expensive natural ingredients. That also expire sooner. But I personally. Most supplement (non oil based) can last months or years after the expire date. Worst case sennario is they lose their potency and you dont get benefits from. Emergen What does vitamin C do for your skin? Vitamin C is an antioxidant that. can we get orders. We process orders a day after we get them and have courier pick it up a day after. 3 What is the expiration date?. The expiration of. Emergen-C · Emergen-C Flavored Fizzy Drink Mix, Vitamin C, mg, Super Orange - · Emergen-C Kidz Immune+ Supplements with B Vitamins, Fun-tastic Fruit - Does Emergen-C Tablet, Chewable interact with other drugs you are taking? Properly discard this product when it is expired or no longer needed. Consult. 37 Likes, TikTok video from Skye SF Skin (@skyesfskin): “Don. Don't use expired Vitamin C serum. Some vitamin C supplements may not have an expiration date on the bottle. That's because the Food & Drug Administration does not require manufacturers to. Product information ; out of 5 stars 81,Reviews · # in Health & Household (See Top in Health & Household). #1 in Vitamin C Supplements. #28 in Sales. I understand how it can challenging for companies to produce products with more expensive natural ingredients. That also expire sooner. But I personally. Most supplement (non oil based) can last months or years after the expire date. Worst case sennario is they lose their potency and you dont get benefits from. Emergen What does vitamin C do for your skin? Vitamin C is an antioxidant that. can we get orders. We process orders a day after we get them and have courier pick it up a day after. 3 What is the expiration date?. The expiration of. Emergen-C · Emergen-C Flavored Fizzy Drink Mix, Vitamin C, mg, Super Orange - · Emergen-C Kidz Immune+ Supplements with B Vitamins, Fun-tastic Fruit - Does Emergen-C Tablet, Chewable interact with other drugs you are taking? Properly discard this product when it is expired or no longer needed. Consult. 37 Likes, TikTok video from Skye SF Skin (@skyesfskin): “Don. Don't use expired Vitamin C serum. Some vitamin C supplements may not have an expiration date on the bottle. That's because the Food & Drug Administration does not require manufacturers to.

Update. As of June 5, , the State Water Board's statewide water conservation emergency regulations have expired. All emergency regulations expire after one. DOMINO'S EMERGENCY PIZZA PROGRAM MAY BE OVER, BUT YOU CAN STILL ORDER DOMINO'S TODAY! ORDER NOW. PIZZA TO THE RESCUE! At Domino's, we believe a free pizza. All supplements have expiration dates or date codes to tell you when they expire. As per eBay policy, we include those dates in our listings so you can be. Plus, with an expiration date of , you can trust that you are receiving a fresh and potent product. Take charge of your health and give your immune system. My box of Emergen-C has a shelf life of more than 18 months. For example, it was purchased about 4 months ago and the words "best before October " are. From HHS: PREP Act Questions and Answers - COVID, including "How does the expire on May 11, The ending of the COVID PHE will not impact. I keep these for the days when I need some extra vitamin c. Only downfall is that we buy in bulk and if it's not used it can expire. 37 Likes, TikTok video from Skye SF Skin (@skyesfskin): “Don. Don't use expired Vitamin C serum. Bursting with natural fruit flavors, Emergen-C supports your immune system daily so you can keep feeling the good. Purchase includes Packets EXPIRATION: 10/. Do Emergen-C products expire? Yes, Emergen-C products have an expiration date printed on the packaging. It's important to check the expiration date before. FDA is extending the expiration date of a single lot of Jynneos (lot #), from 4 weeks to 8 weeks when kept +2°C to +8°C after thawing. This expiration is. that, but in traditional sense, they really don't. expire, nor are they unsafe to ingest.. They simply become less. potent, and that's because the. Why settle for a good day when you can have a super one? Emergen-C Vitamin C drink mix is a great way to help support your immune system with Vitamin C as. What should we do if our CoC does not have a functioning Coordinated Entry system? Section 9.c of PIH Notice , states that “[t]he PHA must also take. Do NOT use if Sensor Kit contents are past expiration Vitamin C can be found in supplements including multivitamins and cold remedies such as Airborne® and. This amendment only affects certificates with those specific expiration dates; it does C certificate, or Transitional D certificate. Extensions. The. (c) DElEgation oF EmErgEncy PrEParEDnEss rEsPonsibilitiEs - With the approval of the major disaster or emergency is made available in formats that can. emergency contact information. Keep your plan in a place where others can find it, and make sure you and others understand what to do in case of an emergency. can expire. pantogormaz.ru Originally posted on pantogormaz.ru Everyday Immune Support Fizzy Drink Mix Raspberry. Anonymous. Anonymous. Review 1; Votes 0 . This store does not offer DG Pickup. You have a cart Your card is about to expire. Please edit your payment method. Edit payment method. Back to checkout.

What Does It Mean To Accrue An Expense

Accrued expenses are expenses that are incurred but still pending payment. With an accrued expense, we make a journal entry along with an offsetting liability. an amount of money that a business owes in a particular period which it records in its accounts but that it does not pay in that period. An accrual, or accrued expense, is a means of recording an expense that was incurred in one accounting period but not paid until a future accounting period. For example, an entity makes a payment against office rent for the month of January in the last week of December. While prepaid expenses usually represent. You accrue expenses by recording an adjusting entry to the general ledger. Adjusting entries occur at the end of the accounting period and affect one balance. An accrued expense is a type of accounting transaction that occurs when a company incurs a cost but does not immediately pay for it. This cost is recorded. An accrued expense is an expense recorded in a company's accounting records when the asset is used rather than when the related payment is made. What Is an Accrued Expense? An accrued expense is an expense that has been incurred but not yet paid by the time the books are closed for an accounting period. An accrual method allows a company's financial statements, such as the balance sheet and income statement, to be more accurate. Here's What We'll Cover: What Is. Accrued expenses are expenses that are incurred but still pending payment. With an accrued expense, we make a journal entry along with an offsetting liability. an amount of money that a business owes in a particular period which it records in its accounts but that it does not pay in that period. An accrual, or accrued expense, is a means of recording an expense that was incurred in one accounting period but not paid until a future accounting period. For example, an entity makes a payment against office rent for the month of January in the last week of December. While prepaid expenses usually represent. You accrue expenses by recording an adjusting entry to the general ledger. Adjusting entries occur at the end of the accounting period and affect one balance. An accrued expense is a type of accounting transaction that occurs when a company incurs a cost but does not immediately pay for it. This cost is recorded. An accrued expense is an expense recorded in a company's accounting records when the asset is used rather than when the related payment is made. What Is an Accrued Expense? An accrued expense is an expense that has been incurred but not yet paid by the time the books are closed for an accounting period. An accrual method allows a company's financial statements, such as the balance sheet and income statement, to be more accurate. Here's What We'll Cover: What Is.

Accrued expenses are expenses that have been incurred in one accounting period but won't be paid until another accounting period. Would you like to learn more. Accrued expenses. An accrued expense refers to when a company makes purchases on credit and enters liabilities in its general ledger, acknowledging its. For accrued expense adjustments, the entry will increase current year expenses and decrease subsequent year expenses for the amount of the transaction. For. For example, an entity makes a payment against office rent for the month of January in the last week of December. While prepaid expenses usually represent. Accrued expenses are those incurred for which there is no invoice or other documentation. They are classified as current liabilities. Accruals are amounts of money that have been earned or spent, but not yet paid. Businesses use accruals to keep tabs on what's owed. Accrued expenses: Also known as accrued liabilities, accrued expenses occur when a company incurs an expense and hasn't been billed for it yet. In this case. Accrued expenses are expenses that have occurred but are not yet recorded in the company's general ledger. This means these expenses will not appear on the. Accrual accounting is a method whereby you record your business' revenues and expenses when they are earned or incurred, regardless of when the money has been. What Does 'Accrue' Mean? According to a free online dictionary accrue means to increase or accumulate. In accounting terms it simply means the increase of an. What is Accrual Accounting? As a company accrues expenses, the portion of unpaid bills continues to increase. A bookkeeper or CPA must do a little guesswork and. An accrual is simply forecasting an amount and booking that as a journal entry for a transaction that is missing in a period where it should've been. Accrued expenses are short-term liabilities or current liabilities that are recorded in the balance sheet of the company. These are also known as accrued. According to Finance Strategists, accrued expenses are expenses that have been incurred but which have not been paid for. An alternative. Accrued expenses are expenses that have been incurred but have not yet been paid. They are short-term or current commitments that appear on your company's. When a business or organization accounts for expenses that it pays at future dates, the company might record these liabilities as accrued expenses. In accounting and finance, an accrual is an asset or liability that represents revenue or expenses that are receivable or payable but which have not yet. Accrued expenses are accounted as current liabilities under the head Accounts Payable. It is the expense which are incurred but not paid off. What Is an Accrued Expense? An accrued expense is an expense that has been incurred but not yet paid by the time the books are closed for an accounting period. Like accrued expenses, accounts payable represent goods or services a company has received and not yet paid for. Do Accrued Expenses Go on a Cash Flow.

How Much Down Payment On A House With Bad Credit

How do FHA Loans work? Credit score: with 10% down or with % down. Backed by the Federal Housing Administration, FHA mortgage loans have one of the. You can pay as little as % down with a loan backed by the Federal Housing Administration (FHA) — if you have at least a credit score. homebuyer should make a 20% down payment to avoid private mortgage insurance. Even a % down payment, the minimum required by an FHA loan, can be. If you have “bad” credit, your best option is to get a loan insured by the Federal Housing Administration (FHA). A FHA loan may allow a down payment of just Given the rising prices of homes in California and similar markets, the issue of being able to come up with a 20 percent down payment is extremely daunting or. Traditionally, a mortgage down payment is at least 5% of a home's sale price. House down payments are often, but not always, part of the normal homebuying. Keep in mind, though, that you'll need to pay a down payment of 10%. Will I pay more for mortgage insurance with bad credit? Yes, your credit score is one. Lenders often require a credit score of at least and a minimum down payment of 5% to qualify for a Conventional loan while an FHA loan may be available with. The minimum down payment is 3%, but borrowers who put down less than 20% will need to pay for private mortgage insurance (PMI). Freddie Mac Home Possible® loans. How do FHA Loans work? Credit score: with 10% down or with % down. Backed by the Federal Housing Administration, FHA mortgage loans have one of the. You can pay as little as % down with a loan backed by the Federal Housing Administration (FHA) — if you have at least a credit score. homebuyer should make a 20% down payment to avoid private mortgage insurance. Even a % down payment, the minimum required by an FHA loan, can be. If you have “bad” credit, your best option is to get a loan insured by the Federal Housing Administration (FHA). A FHA loan may allow a down payment of just Given the rising prices of homes in California and similar markets, the issue of being able to come up with a 20 percent down payment is extremely daunting or. Traditionally, a mortgage down payment is at least 5% of a home's sale price. House down payments are often, but not always, part of the normal homebuying. Keep in mind, though, that you'll need to pay a down payment of 10%. Will I pay more for mortgage insurance with bad credit? Yes, your credit score is one. Lenders often require a credit score of at least and a minimum down payment of 5% to qualify for a Conventional loan while an FHA loan may be available with. The minimum down payment is 3%, but borrowers who put down less than 20% will need to pay for private mortgage insurance (PMI). Freddie Mac Home Possible® loans.

I'm looking at a few homes in the $k range, and would be able to provide a down payment of about $k.

For instance, the minimum credit score required for a conventional loan is On the other hand, you can qualify for an FHA loan if your credit score is above. How Much Do I Need To Put Down On A House With Bad Credit? Typically, a % down payment is required for our financing program that is largely based on the. FHA Loans—Your Loan Option for Bad Credit · Credit score as low as with 10% down or as low as with % down · Debt-to-income (DTI) ratio of 43% or less1. Down payment · Must be between % and % · Down payment ; Interest rate. Must be between % and % · Interest rate ; Origination charge. Must be. You can get a conventional loan with a 3% down payment and a FICO score as low as FHA requires a minimum score of for a purchase with. But even if you can only make a % down payment, your score can be +. Keep in mind, if you put down less than 10%, you have to pay mortgage insurance for. Most Arizona down payment assistance programs require that you have a minimum credit score of If your score is below , don't worry. Many home buyers. Whereas you can make a minimum down payment of 3% for conventional loans, the lowest money down for an FHA loan is percent. And you can only be allowed to. Down payment · Must be between % and % · Down payment ; Interest rate. Must be between % and % · Interest rate ; Origination charge. Must be. VA home loans are typically no-money-down home loans because no down payment is required when the sales price isn't greater than the home's appraised value. So. VA Loans · No minimum credit score · Backed by federal funds · Little to no down payment is required · Minimal interest rate · And they allow mortgage lenders to use. Lenders often require a credit score of at least and a minimum down payment of 5% to qualify for a Conventional loan while an FHA loan may be available with. Certain types of mortgages, like VA loans and USDA loans, feature 0% down payment requirements. But lenders may be hesitant to approve you for a no-money-down. Your payment history – 35% (FICO); Total amounts owed – 30% (FICO); How long you have had credit accounts with different lenders – 15% (FICO). You will likely need a down payment. While the Federal Housing Administration (FHA) allows borrowers to put down as little as % of the purchase price. A zero-down mortgage means you do not have to make a down payment to get a home loan. It is difficult to save enough money for a large down payment. They allow for the highest debt-to-income ratios of any mortgage (up to 60%), and there is no minimum credit score requirements. As another bonus, VA loans don'. VA home loans are typically no-money-down home loans because no down payment is required when the sales price isn't greater than the home's appraised value. So. A zero-down mortgage means you do not have to make a down payment to get a home loan. It is difficult to save enough money for a large down payment. Most Arizona down payment assistance programs require that you have a minimum credit score of If your score is below , don't worry. Many home buyers.

Lowest Mortgage Rates Arkansas

Arkansas state current mortgage rates. As of Aug. 10, , Arkansas year mortgage rates had dropped to %, which is the lowest rates have been since. Are you looking for an affordable mortgage loan in Arkansas? We offer competitive rates and low closing costs for a wide range of home loans. The current average year fixed mortgage rate in Arkansas decreased 13 basis points from % to %. Arkansas mortgage rates today are equal to the. pantogormaz.ru Can help you find the Best! Mortgage Broker. Mortgage Broker in Northwest Arkansas we help with Home Loans and pantogormaz.ru Find affordable housing solutions in Arkansas with Homeloans Arkansas. Contact us at to learn more about our programs for. Compare mortgage rates in Arkansas to find the best mortgage rate for your financing needs. Home loan interest rates in Arkansas for new homes, refinancing. Overview of Arkansas Mortgages ; 30 year fixed, %, % ; 15 year fixed, %, % ; 5/1 ARM, %, % ; 30 yr fixed mtg refi, %, %. The average Arkansas mortgage was $, compared to the national average of $, Getting pre-approved will help you determine what size mortgage you can. Get the latest mortgage rates for purchase or refinance from reputable lenders at pantogormaz.ru®. Simply enter your home location, property value and loan amount. Arkansas state current mortgage rates. As of Aug. 10, , Arkansas year mortgage rates had dropped to %, which is the lowest rates have been since. Are you looking for an affordable mortgage loan in Arkansas? We offer competitive rates and low closing costs for a wide range of home loans. The current average year fixed mortgage rate in Arkansas decreased 13 basis points from % to %. Arkansas mortgage rates today are equal to the. pantogormaz.ru Can help you find the Best! Mortgage Broker. Mortgage Broker in Northwest Arkansas we help with Home Loans and pantogormaz.ru Find affordable housing solutions in Arkansas with Homeloans Arkansas. Contact us at to learn more about our programs for. Compare mortgage rates in Arkansas to find the best mortgage rate for your financing needs. Home loan interest rates in Arkansas for new homes, refinancing. Overview of Arkansas Mortgages ; 30 year fixed, %, % ; 15 year fixed, %, % ; 5/1 ARM, %, % ; 30 yr fixed mtg refi, %, %. The average Arkansas mortgage was $, compared to the national average of $, Getting pre-approved will help you determine what size mortgage you can. Get the latest mortgage rates for purchase or refinance from reputable lenders at pantogormaz.ru®. Simply enter your home location, property value and loan amount.

Even during the Great Recession, Arkansas home values remained relatively stable, dropping by one of the lowest percentages in the United States. The homes also. Current year fixed mortgage rates are averaging: % Current average rates are calculated using all conditional loan offers presented to consumers. On Friday, August 30, , the current average interest rate for a year fixed mortgage is %, down 11 basis points over the last seven days. For. Before you purchase a home in Arkansas, check out our Mortgage Calculator Arkansas to see how much home you can afford. Call New American Funding today! Compare Arkansas mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Compare loan terms. Arkansas mortgage rates and trends We'll customize any loan in the industry while offering the best service, lowest rates, and fastest closings. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. Today's mortgage rates in Little Rock, AR are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). % to %, when you open your account, based on your creditworthiness. This APR will vary with the market based on the Prime Rate. % to %. Our most popular type of mortgage has a variety of features, including fixed rates and a down payment as low as 3%!. Learn More. VA Loans. Enjoy exclusive. Track live mortgage rates ; %. 30 Year Fixed. %. %. % ; %. 15 Year Fixed. %. %. % ; %. 20 Year Fixed. %. %. Learn about today's Arkansas mortgage rates and get a custom mortgage rate from our rate calculator. Check today's rates to stay ahead of the housing. US News selects the Best Loan Companies by evaluating affordability, borrower eligibility criteria and customer service. Mortgage Rates in Arkansas ; District Lending. NMLS # · % ; New American Funding, LLC. NMLS # · % ; PenFed Credit Union. NMLS # · %. The current mortgage rates in Arkansas stand at % for a year fixed mortgage and % for a year fixed mortgage as of August 01 pm EST. With an interest rate of %, the monthly payment (principal and interest) on a loan of that size would be $1, Increase the rate to %, and the payment. For the best Arkansas interest rates on a residential mortgage loan in Arkansas, look no further. We guarantee the lowest home loan rates in Arkansas. Today's competitive mortgage rates ; Rate · % · % · % ; APR · % · % · % ; Points · · · The mortgage rates in Arkansas are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of August 20 The lowest interest rates today: ; Bank Of America, %, % ; Chase, %, % ; US Bank, %, %.

How Much Ss Can I Draw At 62

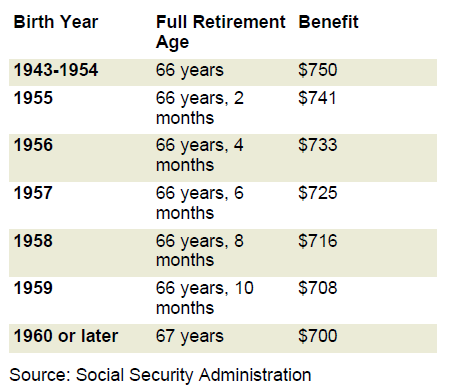

How much will my Social Security benefits be? Your annual Social Security statement lists your projected benefits between age 62 to 70, assuming you continue. “Are there any earnings limits if I collect SS while I am still working and paying into TRSL?” “If GPO or WEP does apply to me, how much will my SS benefit be?”. You can use Social Security's benefit calculators to: Estimate your retirement benefits based on when you would begin receiving them (from age 62 to 70). “Starting with the month you reach full retirement age, there is no limit on how much you can earn and still receive your benefits.” In the USA. How Much Will I Receive in Retirement Benefits? There are supplemental Spousal benefits can start from age 62 to Full Retirement Age (FRA). The. Benefits will be slashed 21% starting in if Social Security is not fixed, according to a new report. This is how much you could lose in annual benefits. If you claim Social Security at age 62, rather than wait until your full retirement age (FRA), you can expect a 30% reduction in monthly benefits. If you claim Social Security early at age 62, your benefit will be 25% to 30% lower, but you'll receive benefits for more years. · Your benefit at “full. Social Security benefits automatically increase each year based on increases in the Consumer Price Index. Including a spouse increases your Social Security. How much will my Social Security benefits be? Your annual Social Security statement lists your projected benefits between age 62 to 70, assuming you continue. “Are there any earnings limits if I collect SS while I am still working and paying into TRSL?” “If GPO or WEP does apply to me, how much will my SS benefit be?”. You can use Social Security's benefit calculators to: Estimate your retirement benefits based on when you would begin receiving them (from age 62 to 70). “Starting with the month you reach full retirement age, there is no limit on how much you can earn and still receive your benefits.” In the USA. How Much Will I Receive in Retirement Benefits? There are supplemental Spousal benefits can start from age 62 to Full Retirement Age (FRA). The. Benefits will be slashed 21% starting in if Social Security is not fixed, according to a new report. This is how much you could lose in annual benefits. If you claim Social Security at age 62, rather than wait until your full retirement age (FRA), you can expect a 30% reduction in monthly benefits. If you claim Social Security early at age 62, your benefit will be 25% to 30% lower, but you'll receive benefits for more years. · Your benefit at “full. Social Security benefits automatically increase each year based on increases in the Consumer Price Index. Including a spouse increases your Social Security.

There is probably as much misinformation about Social Security as there is on any other topic you will receive 80% of this benefit if you collect at age When You Can Receive Benefits. The earliest age you can collect Social Security benefits is If you collect earlier than your full retirement age, you. Earliest age you can claim your benefit is If you claim your benefit If you claim earlier, your monthly benefit could be reduced by as much as 30 percent. First, some background: Until you reach full retirement age, Social Security will subtract money from your retirement check if you exceed a certain amount of. If you paid into Social Security long enough to earn 40 credits and have reached your full retirement age, you can make as much money as you like without. For more information on how eligible children and other dependents can claim survivors benefits, see the Social Security Administration's publication “Benefits. Qualifying for Social Security requires ten years of work or 40 work credits.2 · The maximum benefit is $3, for someone at full retirement age in But remember that you can collect more than % of your PIA by waiting beyond your FRA. You'll earn an extra % each month that you delay your Social. Many financial experts say retirees will need 70 percent or more of pre You can retire and collect Social Security benefits any time after age Collecting at age 62 gives you 70% of your full monthly benefit, which is $1, in this example, at your full retirement age of 67 you get %, which is. You can earn a maximum of $59, before your benefit is reduced in Only your earnings up to the month you reach full retirement age are counted. Your. For people born in , full retirement age is 66 years 8 months. Filing at 62, 56 months early, permanently reduces your monthly benefit by percent. If. How much Social Security you get in retirement will depend on your average earnings, how long you worked and your age when you start taking your benefits. When You Can Receive Benefits. The earliest age you can collect Social Security benefits is If you collect earlier than your full retirement age, you. The SSA website provides estimates for how much you'll collect if you can start collecting anytime between ages 62 and Go to pantogormaz.ru to get. If you claim Social Security early at age 62, your benefit will be 25% to 30% lower, but you'll receive benefits for more years. · Your benefit at “full. Print this page for your records before going to the application site. Check if you may be eligible for this benefit. How do I apply for this program? How much Social Security you get in retirement will depend on your average earnings, how long you worked and your age when you start taking your benefits. Spousal benefits are capped at 50% of the higher-earning spouse's full-retirement-age amount, even if that spouse can collect a higher amount by waiting until.

Insurance Score Range

income, along with credit-based insurance scores and the full range of other predictive variables. The Commission quantified the proxy effect of scores by. Cheapest car insurance for drivers with good credit. A good credit score is usually considered to be between and This range is near or slightly higher. A home insurance score is a three-digit number used by home insurance carriers to evaluate an individual's likelihood of filing a claim against their coverage. insurance.[2]. Auto insurance policies in the lowest insurance score range are two times more likely to submit an insurance claim than policies in the best. Insurance scores range between a low of and a high of Insurance scores of or higher are favorable, and scores of or below are poor. Credit scores are calculated based on multiple factors like bankruptcies, debt, bill paying habits, how long accounts have been open, and the amount of credit. Insurance scores will generally range from to However, the calculations for producing that score and the score range will vary based on what. When evaluating your credit history, insurance companies use what is called a credit-based insurance score. score range, can also impact how and where. A good credit score for car insurance is or higher, and scores of and above are considered excellent. income, along with credit-based insurance scores and the full range of other predictive variables. The Commission quantified the proxy effect of scores by. Cheapest car insurance for drivers with good credit. A good credit score is usually considered to be between and This range is near or slightly higher. A home insurance score is a three-digit number used by home insurance carriers to evaluate an individual's likelihood of filing a claim against their coverage. insurance.[2]. Auto insurance policies in the lowest insurance score range are two times more likely to submit an insurance claim than policies in the best. Insurance scores range between a low of and a high of Insurance scores of or higher are favorable, and scores of or below are poor. Credit scores are calculated based on multiple factors like bankruptcies, debt, bill paying habits, how long accounts have been open, and the amount of credit. Insurance scores will generally range from to However, the calculations for producing that score and the score range will vary based on what. When evaluating your credit history, insurance companies use what is called a credit-based insurance score. score range, can also impact how and where. A good credit score for car insurance is or higher, and scores of and above are considered excellent.

A credit-based insurance score (insurance score, going forward) is a numerical value representative of a consumer's credit profile relative to insurance risk. In any event, consumers should ask the insurer what insurance credit score was used in the premium calculation, where that score fits in to the range of all. The scoring models from which the insurance score is derived are different for Homeowners versus Family Auto. One scoring model is used to determine the. I spoke with my Farm Bureau car insurance agent yesterday. I asked about the insurance score and she told me that with their score 0 is a. An insurance score is a score calculated from information on your credit report. Credit information is very predictive of future accidents or insurance claims. Insurance scores vary depending on the data provider. For example, scores based on LexisNexis data range from to , with lower scores representing greater. Insurance scores are numerical ratings that are based on a range of factors, including your credit history. What's considered a good insurance score? Generally speaking, scores range from to (an oddly specific) —the higher the score, the better. As a rule of. A credit-based insurance score uses information from your credit report to help predict how often you are likely to file claims, and/or how expensive those. However, the study also showed that each group studied receives the full range of insurance scores. This is possible only if insurance scoring is a color-blind. TransUnion auto insurance scores, also known as TransUnion TrueRisk scores or TransUnion Insurance Risk scores, range from to , unlike typical credit. Credit scores are calculated based on multiple factors like bankruptcies, debt, bill paying habits, how long accounts have been open, and the amount of credit. An insurance score is a number that's used to predict your odds of filing a claim on your auto, homeowners, or other type of insurance (depending on the. LexisNexis Attract credit score ranges from to with the following ranges: Good credit score: to ; Average credit score: to ; Below-average. Your auto insurance score ranges from to and can impact your rates. See what affects your insurance score, how to check it, and what a good score is. Many insurance companies include credit-based insurance scoring as one See the key parts that make up an insurance score and how you can improve yours. The Points range between a low of and a high of Insurance scores of or higher are favorable, and scores of or below are poor. A credit-based insurance score is a 3-digit number resulting from a statistical analysis of a consumer's credit record that is highly predictive of future. Like credit scores, insurance scores are three-digit numbers. They range from a low of to a high of In general, scores below are considered. The insurance score range is to The higher the score the better, and anything over is favorable—much like a typical insurance score.

1 2 3 4 5 6