pantogormaz.ru

Community

Highest Paid Work From Home Careers

We're talking about top-tier, good-paying work-from-home jobs across various fields – tech wizards creating the next big thing in their pajamas, marketing. Work Experience Over Time · Business Employment Dynamics · Foreign Direct OOH HOME |; OCCUPATION FINDER |; OOH FAQ |; HOW TO FIND A JOB |; A-Z INDEX |; OOH. The highest-paying work-from-home jobs are computer and information systems managers, with a median salary of $, per year and fast growth in the field;. These are the occupations with the highest median wages as of May (the latest wage data available). You can view this list for any state by changing the. 16 Online Jobs You Can Land With Little to No Experience ; View online data entry clerk jobs on The Muse» Average salary in $36, ; View online. 6 High-Paying Remote Jobs You Can Land With No Remote Experience · 1. Remote Developer · 2. Remote Web Designer · 3. Remote Project Manager · 4. Remote Content. The salary may range from $20 to $ per hour from my experience. Depends on the role requirements. With bigger team leadership it will go even. Work From Home Disability Determination Specialist · Work From Home Note Taker · Work From Home Redline Recruitment · Work From Home Contact Lens Representative. Below, we outline the jobs and companies that make working from home fiscally rewarding and, in most cases, stress-reducing. We're talking about top-tier, good-paying work-from-home jobs across various fields – tech wizards creating the next big thing in their pajamas, marketing. Work Experience Over Time · Business Employment Dynamics · Foreign Direct OOH HOME |; OCCUPATION FINDER |; OOH FAQ |; HOW TO FIND A JOB |; A-Z INDEX |; OOH. The highest-paying work-from-home jobs are computer and information systems managers, with a median salary of $, per year and fast growth in the field;. These are the occupations with the highest median wages as of May (the latest wage data available). You can view this list for any state by changing the. 16 Online Jobs You Can Land With Little to No Experience ; View online data entry clerk jobs on The Muse» Average salary in $36, ; View online. 6 High-Paying Remote Jobs You Can Land With No Remote Experience · 1. Remote Developer · 2. Remote Web Designer · 3. Remote Project Manager · 4. Remote Content. The salary may range from $20 to $ per hour from my experience. Depends on the role requirements. With bigger team leadership it will go even. Work From Home Disability Determination Specialist · Work From Home Note Taker · Work From Home Redline Recruitment · Work From Home Contact Lens Representative. Below, we outline the jobs and companies that make working from home fiscally rewarding and, in most cases, stress-reducing.

Corporate chief executives are in the highest-paid profession outside of the healthcare field. The average projected growth rate for all jobs between to. Data science is a rapidly growing field, which makes it one of the most in-demand and high-paying work-from-home jobs. Data scientists gather, organize, and. New Home Sales Consultant: Highest Potential Salary: $,; Investment Consultant: Highest Potential Salary: $, *The highest annual salaries displayed. A two-year degree can launch you into a new career. Learn which associate degree jobs will earn you the highest salary - as much as $! 18 Remote Jobs That Pay Well · 1. Art Director · 2. Business Development Manager · 3. Clinical Trial Manager · 4. Cloud Architect · 5. Cybersecurity Analyst · 6. Median annual salary: $80, · Number of jobs: , · Estimated job growth (–): 16% · Educational requirements: Ranging from a high school diploma to a. Here we reveal the ten highest-paying work from home jobs for those wishing to begin or progress their careers. Corporate chief executives are in the highest-paid profession outside of the healthcare field. The average projected growth rate for all jobs between to. For those of you who love turning visions into digital reality, a web designer might be the best remote tech job for you. Your skills may include graphic design. There are a number of remote jobs that pay well. Some of the most common include jobs in customer service, data entry, and telemarketing. In the modern job market, high-paying remote jobs are expanding. From sales to marketing, companies are searching for talented professionals. In this guide, we list the highest-paying work-from-home jobs that you can take up today to make money for extra expenses or ensure savings for a rainy day. Data Entry Clerk. Data entry clerk is another position best suited for those who prefer a work-from-home job requiring little to no experience. This job often. Work From Home Disability Determination Specialist · Work From Home Note Taker · Work From Home Redline Recruitment · Work From Home Contact Lens Representative. According to data from job site Indeed, the top five jobs that pay over $75, per year as a remote worker include software development engineer, web developer. Some of the best paying tech jobs include computer and information research scientist, computer programmer, and computer systems analyst. Remote business analysts have one of the best remote IT jobs, where they are responsible for analyzing and improving the business processes, operations, and. Full-time, Part-time, Freelance, Entry-level, High-paying, International, Remote High-Paying Jobs – Work From Home, See all Remote Jobs. Top 10 Highest Paying Online & Remote Jobs (Inc Salaries) · 1. Mobile Developer · 2. Software Architect · 3. Data Scientist · 4. Development Operations. 7 Highest Paying Remote Jobs (In-Demand Remote Jobs) · 1. Web/Software Developer · 2. Content Writer · 3. Graphic Designers · 4. Mobile Developers.

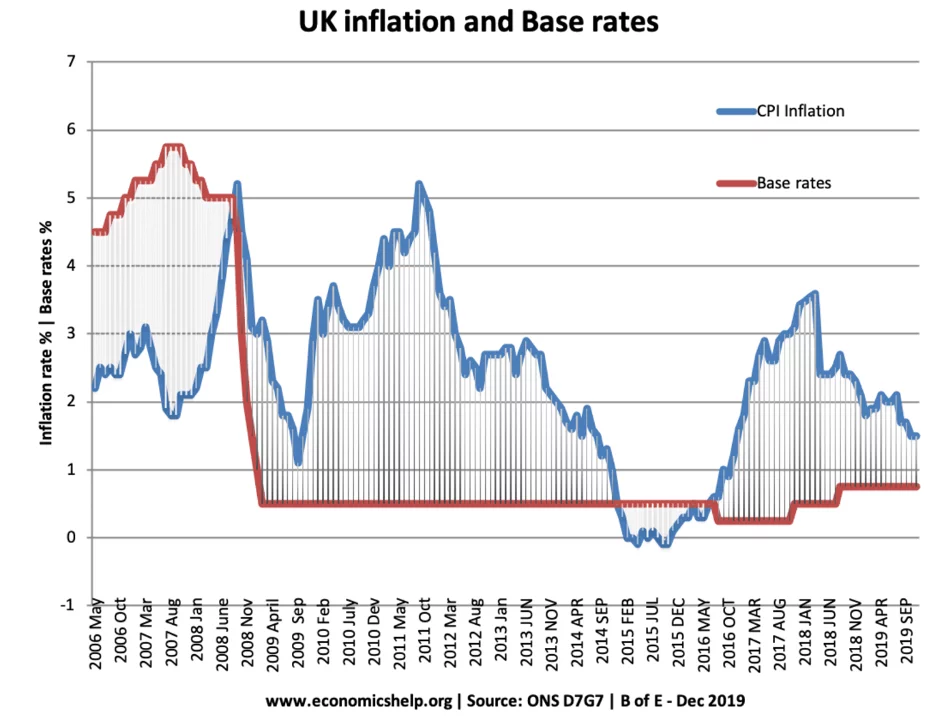

Interest Rates In London

Observer business agenda · UK inflation rises to % in first increase since December · Bank of England could still cut interest rates again despite rise in. The current Bank of England base rate is 5% as of 1st August The next review is scheduled for 19th September The Bank of England cut interest rates at the July 31 meeting of the Monetary Policy Committee (MPC). Members voted to cut rates to 5% from %, the first. Below, we have detailed for you the rise and fall of the UK interest rates over time, between - In the United Kingdom, the official bank rate is the rate that the Bank of England charges banks and financial institutions for loans with a maturity of 1. Interest rates ; Why the days of 5pc savings rates are numbered. Indecisive savers should take action and lock in top deals before they disappear. Joe Wright. A fixed-rate mortgage means that your payments will stay the same until the end date of the fixed-rate period, even if interest rates change. Best current mortgage rates · Monthly repayment£ · Loan to value60 % · Initial interest rate % · Variable rate % · APRC% · Product fees£ 1, United Kingdom Interest Rate Decision ; Actual: % ; Forecast: % ; Previous: %. Observer business agenda · UK inflation rises to % in first increase since December · Bank of England could still cut interest rates again despite rise in. The current Bank of England base rate is 5% as of 1st August The next review is scheduled for 19th September The Bank of England cut interest rates at the July 31 meeting of the Monetary Policy Committee (MPC). Members voted to cut rates to 5% from %, the first. Below, we have detailed for you the rise and fall of the UK interest rates over time, between - In the United Kingdom, the official bank rate is the rate that the Bank of England charges banks and financial institutions for loans with a maturity of 1. Interest rates ; Why the days of 5pc savings rates are numbered. Indecisive savers should take action and lock in top deals before they disappear. Joe Wright. A fixed-rate mortgage means that your payments will stay the same until the end date of the fixed-rate period, even if interest rates change. Best current mortgage rates · Monthly repayment£ · Loan to value60 % · Initial interest rate % · Variable rate % · APRC% · Product fees£ 1, United Kingdom Interest Rate Decision ; Actual: % ; Forecast: % ; Previous: %.

Bank Lending Rate in the United Kingdom remained unchanged at percent in March. This page provides - United Kingdom Prime Lending Rate - actual values. A fixed-rate mortgage means that your payments will stay the same until the end date of the fixed-rate period, even if interest rates change. August ushered in the lowest ever Bank of England Base rate at a staggering %. To put this in perspective, the highest Bank of England Base Rate. The current base rate. The base rate has changed to %. There's no need to call us - we'll write to you if there are any changes to your payments as a result. LIBOR stands for London InterBank Offered Rate. Originally, LIBOR was an indicative average interest rate at which a selection of banks were prepared to lend. Current interest rates ; Handelsbanken Base Rate, 23 August ; Bank of England Base Rate, , 1 August ; Handelsbanken Standard Variable*, The current interest rate cap is %. Previous interest rates. The rates in the table apply to Plan 2 loans only. The amounts shown are the maximum for each. Interest Rates · The unsurprising decision keeps borrowers' noses to the grindstone. Bah humbug. Business Comment · The Bank of England has held interest rates. This page contains an overview of the current / latest and historical British pound sterling LIBOR interest rates. Current interest rates payable ; Currency, Rate, Effective Date ; GBP, %, ; USD, %, ; AUD, %, ; EUR, %, The London Interbank Offered Rate (LIBOR) was a benchmark interest rate for short-term loans between major global banks. It was phased out in The Bank of England base rate influences interest rates in the UK, which can impact mortgage and savings rates. The current base rate is 5%. It's the rate the Bank of England charges other banks and other lenders when they borrow money, and it's currently %. The base rate influences the interest. Summer - April. Benefits. Taught by an industry professional; Access to online materials; Awarded a City, University of London certificate. POUNDS STERLING Official base rates, averaged monthly ; EURO Official base rates, averaged monthly ; US DOLLAR Prime Rates, averaged monthly ; SOFR (Secured. Immediate Rates: Less than 24 Hours: London Clearing Banks Rate for the United Kingdom (DISCONTINUED). Percent, Not Seasonally Adjusted. Monthly Sep to. The Bank of England base rate changed on 1 August This means that the new Chase saver rate is % AER (% gross) variable. If you have a Chase saver. Interest Rates ; SME bosses are increasingly confident about the future of the UK · Peel Hunt is latest major City name to back "stable and growing" UK ; Rightmove. Interest rates have now risen to the highest level since as the Bank of England tries to stem the pace of rising prices. In June, with inflation currently. How is the Bank of England base rate set? The Bank's Monetary Policy Committee (MPC) meets to discuss and set UK interest rates eight times a year. This.

How To Close Credit Card Accounts Without Affecting Credit Score

It will probably hurt your score by lowering your average age of accounts. If it doesn't have an annual fee I would say just leave it open. Does. Many factors go into your credit score, and canceling a credit card can impact most of them. Sometimes closing a credit card account can positively impact your. Canceling a credit card can negatively impact your credit score, so make sure to consider all your options carefully. You can keep the credit account open. If you have debt on other accounts, losing the available credit can reduce your debt-to-available-credit ratio, which can affect your credit score. Enhanced. Perhaps most significantly, closing an account may impact the variables that contribute to your credit score, such as the overall age of your credit lines or. If you still decide to close some accounts to help your credit score, start by looking at inactive accounts that you no longer use. Cards that you don't use. Closing a credit card could lower the amount of overall credit you have versus the amount of credit you're using (your debt to credit utilization ratio), which. Many factors go into your credit score, and canceling a credit card can impact most of them. Sometimes closing a credit card account can positively impact your. You have a right to cancel your card. I would write them a letter, at the address listed for the account on your credit reports, and inform them. It will probably hurt your score by lowering your average age of accounts. If it doesn't have an annual fee I would say just leave it open. Does. Many factors go into your credit score, and canceling a credit card can impact most of them. Sometimes closing a credit card account can positively impact your. Canceling a credit card can negatively impact your credit score, so make sure to consider all your options carefully. You can keep the credit account open. If you have debt on other accounts, losing the available credit can reduce your debt-to-available-credit ratio, which can affect your credit score. Enhanced. Perhaps most significantly, closing an account may impact the variables that contribute to your credit score, such as the overall age of your credit lines or. If you still decide to close some accounts to help your credit score, start by looking at inactive accounts that you no longer use. Cards that you don't use. Closing a credit card could lower the amount of overall credit you have versus the amount of credit you're using (your debt to credit utilization ratio), which. Many factors go into your credit score, and canceling a credit card can impact most of them. Sometimes closing a credit card account can positively impact your. You have a right to cancel your card. I would write them a letter, at the address listed for the account on your credit reports, and inform them.

Closing a new account will have less of an impact. To keep your credit score in good standing, it's important to remember to stick with a low balance that can. Closing a Credit Card Without Hurting Your Credit Score Thinking about closing that credit card? If you're struggling to pay off credit card debt closing a. Make timely payments towards your outstanding balance. Clear the unpaid amount each month to keep your debt low. · Make frequent applications for new cards to. How to cancel a credit card without damaging your credit score · Pay your credit card balance down to $0. · Redeem any rewards you have in your account. · Contact. Closing a new account will have less of an impact. To keep your credit score in good standing, it's important to remember to stick with a low balance that can. The primary reason your score may decrease is through losing a credit limit and increasing your utilization rate. “When you close a credit card account, you. So, cancelling a credit card may impact your score, but it really depends on the lender. One reason your score may be negatively affected is that your overall. This ratio accounts for 30% of your credit score. Keeping your balances around 30% or less of your available credit is best. By keeping a credit card open (even. Click on the “I want to” button and find “Close Account” under the "Control Your Card" section. From here, you'll be guided through how to close your credit. Closing a credit card may hurt your credit score by increasing your credit utilization ratio. Learn more. Experts generally recommend you don't cancel a credit card because it can have a negative impact on your credit score. But if you're being charged a high annual. Perhaps most significantly, closing an account may impact the variables that contribute to your credit score, such as the overall age of your credit lines or. High annual fees · You no longer use the card · You want to proactively limit your spending capacity · You're paring down open accounts following an identity theft. The higher your balance-to-limit ratio, the more it can hurt your credit. You're removing old credit. Your credit score also depends on the average age of your. The key is to avoid closing your oldest and highest-limit accounts, especially if they don't charge annual fees. And if you really need to close such an account. CONSIDER AGE OF THE CARD: Closing your oldest card can cause your credit history to appear shorter, which may harm your credit score. 2. CANCEL ALL AUTO-. If the account you want to close is a newer one, closing it could have a much smaller impact on your credit score when its history is removed. You have too many. Closing a credit card may hurt your credit score by increasing your credit utilization ratio. Learn more. The cancellation may impact your debt to credit utilization ratio and your mix of credit accounts. You may not have given much thought to the credit card in.

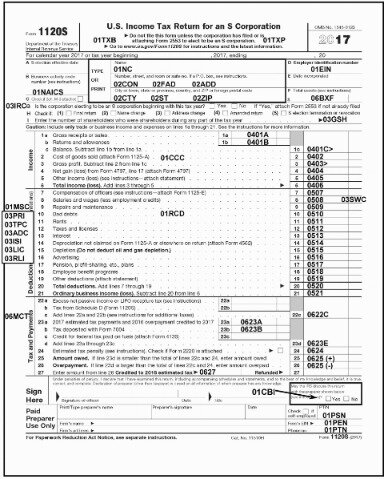

Software To File 1065

Our powerful TaxWise Desktop software stores your tax return data on your machine and provides access to both Individual and , , S, , File taxes on your own with software. Starting at. $ One state return fee Form Get your documents ready. To help you prepare for your tax. TaxAct includes an option to complete tax prep and filings for partnership and corporations completely online and is the only place you can prepare taxes. Form NameComposite Filing Instructions, Form NumberI ; Form NamePartnership Tax Payment Voucher, Form NumberSCV ; Form NameRequest for Extension of Time. You can file Florida Form F electronically through the Internal Revenue Service's (IRS) Modernized e-File. (MeF) Program using electronic transmitters. Software Limitations. Does not support: Schedule K-1N, Form SN, Form N, Form N; Form N, Individual Underpayment of Estimated Tax, reported on. We designed this small business tax software so that you'd have everything you need to file federal, state, and business taxes easily, accurately, and on time. You can file Form using TurboTax Business. You must sign in to vote software · TurboTax online guarantees · TurboTax security and fraud protection. This page includes information on firms that provide e-filing products and services for business taxpayers, including those that file Form using the MeF. Our powerful TaxWise Desktop software stores your tax return data on your machine and provides access to both Individual and , , S, , File taxes on your own with software. Starting at. $ One state return fee Form Get your documents ready. To help you prepare for your tax. TaxAct includes an option to complete tax prep and filings for partnership and corporations completely online and is the only place you can prepare taxes. Form NameComposite Filing Instructions, Form NumberI ; Form NamePartnership Tax Payment Voucher, Form NumberSCV ; Form NameRequest for Extension of Time. You can file Florida Form F electronically through the Internal Revenue Service's (IRS) Modernized e-File. (MeF) Program using electronic transmitters. Software Limitations. Does not support: Schedule K-1N, Form SN, Form N, Form N; Form N, Individual Underpayment of Estimated Tax, reported on. We designed this small business tax software so that you'd have everything you need to file federal, state, and business taxes easily, accurately, and on time. You can file Form using TurboTax Business. You must sign in to vote software · TurboTax online guarantees · TurboTax security and fraud protection. This page includes information on firms that provide e-filing products and services for business taxpayers, including those that file Form using the MeF.

Partnerships file a Form , and each partner receives an IRS Schedule K-1 from that return. Each partner then reports the information from the Schedule K. You can electronically file Forms IL, Corporation Income and Replacement Tax Return; IL File (MeF) program using third-party software. MeF is a web-. prepare and file tax year Rhode Island returns until both approvals are granted. Please note this information is based on the software vendor's Letter. For general information, see the Franchise Tax Overview. File and Pay Franchise Tax. Approved Tax Preparation Software Providers · Filing and Payment. File Partnership and LLC taxes with TaxAct. Our online business tax return software saves time and maximizes tax deductions. For the Tax Year ; Drake Software E. Palmer St. Franklin, NC , Drake Software, pantogormaz.runs In A New Window ; Thomson. A taxpayer can e-file using commercial tax preparation software, a paid preparer, or an authorized e-file provider. file Form A return for this purpose. Free support for independent contractors, freelancers, sole proprietors and more. Hundreds of deductions, write-offs, and credits built into the online. Partnership (IA ), Tax years Inadequate tax preparation software (i.e. software that does not support all forms necessary to file a complete return). The Mississippi Department of Revenue (DOR) is participating in the Fed/State / Modernized e-File project for the electronic filing of corporate and. Our tax experts help you minimize your tax bill if you need to file as a general partnership, limited partnership (Form ), or Multi‑member LLC. Sole. Includes Total Tax Returns · Federal & State Individual · Federal & State Business Returns ( and S now available in TaxWise Online) · Free. FEATURES · 25 created tax returns plus ALL states supported · Individual , NR, , S, , , , , 7· Free e-file · Multi-user. E-File for Software Developers · Arizona MeF Letter of Intent · TPTFile ) and all federal supporting schedules with their Arizona income tax return. electronic filing program. The following links provide information and guidance for e-File Providers for the Maryland Fed/State MeF/ e-File Program. Federal filing is free to use · Audit defense available with the Deluxe edition, which gives you support from a representative if the IRS audits your federal tax. FreeTaxUSA is a great alternative to high priced tax software such as TurboTax and H&R Block. · FreeTaxUSA is a great company that makes tax filing easy and. No, you cannot file the partnership business return using this software. You can file only your portion of the Schedule K-1 you received as a partner along with. Common Features · Familiar features - Data entry and program features are essentially the same across all tax packages. · E-filing is included, for any return. Partnerships can file the MO return and attachments by using a tax preparer or software approved by the IRS as an Electronic Return Originator (ERO).

Ledger Amazon

Nano Device, Massive Possibilities. Ledger Nano S Plus permits to have up to coin applications* installed at the same time. Online shopping from a great selection at Ledger Official Store. Ledger Nano X permits to have up to coin applications installed at the same time. Which lets you manage up to coins with a single wallet. Secure and manage your crypto and NFTs with Ledger's most popular wallet, Ledger Nano S Plus. Review your transactions with ease and take control while on the. Unlock a world of crypto possibilities with the iconic Ledger Nano X. The most advanced Bluetooth-enabled hardware wallet to securely manage all your crypto. Our Amazon Network. Do not hesitate to visit our Amazon official stores. Amazon devices are guaranteed to be genuine and benefit from the same updates and. Ledger Nano S Plus permits to have up to coin applications installed at the same time. Which lets you manage up to coins with a single wallet. Image of Ledger Nano X Crypto Hardware Wallet (Onyx Black) - Bluetooth - The · Image of Ledger Nano X (Pastel Green) - Secure and Manage Your Crypto &. Ledger Nano X S Case, Waterproof & Shockproof Accessory Case, Military Level Portable Storage Container,Carrying Storage Organizer for Protecting Crypto Wallet. Nano Device, Massive Possibilities. Ledger Nano S Plus permits to have up to coin applications* installed at the same time. Online shopping from a great selection at Ledger Official Store. Ledger Nano X permits to have up to coin applications installed at the same time. Which lets you manage up to coins with a single wallet. Secure and manage your crypto and NFTs with Ledger's most popular wallet, Ledger Nano S Plus. Review your transactions with ease and take control while on the. Unlock a world of crypto possibilities with the iconic Ledger Nano X. The most advanced Bluetooth-enabled hardware wallet to securely manage all your crypto. Our Amazon Network. Do not hesitate to visit our Amazon official stores. Amazon devices are guaranteed to be genuine and benefit from the same updates and. Ledger Nano S Plus permits to have up to coin applications installed at the same time. Which lets you manage up to coins with a single wallet. Image of Ledger Nano X Crypto Hardware Wallet (Onyx Black) - Bluetooth - The · Image of Ledger Nano X (Pastel Green) - Secure and Manage Your Crypto &. Ledger Nano X S Case, Waterproof & Shockproof Accessory Case, Military Level Portable Storage Container,Carrying Storage Organizer for Protecting Crypto Wallet.

pantogormaz.ru Return Policy: pantogormaz.ru Voluntary Day Return Guarantee: You can return many items you have purchased within 30 days following delivery of the. About this item · Immerse yourself in the first E Ink secure touchscreen experience, powered by Ledger's uncompromising security. · Trusted by millions: Powered. Absolutely NOT. If you want to be sure it's authentic, buy it from the source. Amazon is overrun with sellers (many of them foreign) making up. Ledger is back in stock on Amazon USA under the seller name "Ledger Official". Direct buying link for the Nano S pantogormaz.ru It is generally safe to buy a Ledger device from Amazon, especially if you follow the link from the official Ledger website. Buy Ledger Backup Pack Nano S Plus + Nano X - Crypto Hardware Wallets: USB Flash Drives - pantogormaz.ru ✓ FREE DELIVERY possible on eligible purchases. Ledger Live, one app for all your crypto needs: Use your Ledger with pantogormaz.ru Return Policy: pantogormaz.ru Voluntary Day Return Guarantee: You. Amazon Prime Day has officially landed! Follow along here for the best deals in realtime on tech, school essentials, beauty supplies and. The Morning Ledger: Amazon Leans Into Generative AI to Manage Its Finances. Amazon's finance teams are turning to generative AI in areas such. Ledger Nano X (Amethyst Purple) - Secure and Manage Your Crypto & NFTs on-The-go with Our Bluetooth®-Enabled Hardware Wallet. Buy Ledger Nano S Cryptocurrency Hardware Wallet, Black: External Hard Drives - pantogormaz.ru ✓ FREE DELIVERY possible on eligible purchases. Amazon QLDB is a fully managed ledger database that provides a transparent, immutable, and cryptographically verifiable transaction log. Amazon has recently introduced a new inventory ledger that will help sellers track their inventory levels more effectively. The ledger provides detailed. I bought from Amazon through an 'authorised' dealer. I just tried to update the firmware and received a 'MCU firmware not genuine' message. Do NOT but from. Yes. Just wipe it clean. But remember you are responsible for the security of your funds. If it risky buy one off Amazon then why do it? Just be. Ledger Stax was made for the day-to-day use of your crypto & NFTs with clarity and comfort. Clear-sign your transactions with ease on the world's first curved. Amazon Prime Day has officially landed! Follow along here for the best deals in realtime on tech, school essentials, beauty supplies and more. Buy Ledger Nano S Plus (Pastel Green): The Perfect Entry-Level Hardware Wallet to securely Manage All Your Crypto and NFTs.: USB Flash Drives - pantogormaz.ru Buy Ledger Family Pack S Plus - 3 Ledger Nano S Plus Crypto Hardware Wallets: USB Flash Drives - pantogormaz.ru ✓ FREE DELIVERY possible on eligible purchases.

Best Stablecoin Yield Farming

YieldFlow is in the Leading DeFi Yield Farming Platforms that stands out for its high APYs. This innovative service strives to turn unused cryptocurrencies into. Yield Yak provides auto-compounding yield farms, (DEX) aggregator, and liquid staking tools. Avalanche Logo. PoolTogether Logo PoolTogether. DeFi Yield. Best Stablecoin Yields Greater than 20%— Base Edition · Base is really hot right now · BaseSwap: Up to 22% APR · Swapbased: Up to 86% APR. This system enables better capital efficiency for both yield farmers and lenders. stablecoin and stablecoin assets in a leveraged position. Popular. These conditions are not favorable to stablecoin farmers, who are often risk-averse, or to new users who cannot obtain PTP cost-effectively. Echidna eliminates. Today's Yield Farming Coins Prices ; R · Rally. RLY. $ $ +%. +% ; H · Harvest Finance. FARM. $ $ +%. +%. The best yield farms (or at least the highest value ones) are on ETH (Aave, Curve, UNI, etc.), but BSC has enough large projects including CAKEs and Venus. Yield Yak offers a comprehensive suite of tools including auto-compounding yield farms, a decentralized exchange (DEX) aggregator, and liquid staking solutions. Yield farming projects allow users to lock their cryptocurrency tokens for a set period to earn rewards for their tokens. Yield farms use smart contracts to. YieldFlow is in the Leading DeFi Yield Farming Platforms that stands out for its high APYs. This innovative service strives to turn unused cryptocurrencies into. Yield Yak provides auto-compounding yield farms, (DEX) aggregator, and liquid staking tools. Avalanche Logo. PoolTogether Logo PoolTogether. DeFi Yield. Best Stablecoin Yields Greater than 20%— Base Edition · Base is really hot right now · BaseSwap: Up to 22% APR · Swapbased: Up to 86% APR. This system enables better capital efficiency for both yield farmers and lenders. stablecoin and stablecoin assets in a leveraged position. Popular. These conditions are not favorable to stablecoin farmers, who are often risk-averse, or to new users who cannot obtain PTP cost-effectively. Echidna eliminates. Today's Yield Farming Coins Prices ; R · Rally. RLY. $ $ +%. +% ; H · Harvest Finance. FARM. $ $ +%. +%. The best yield farms (or at least the highest value ones) are on ETH (Aave, Curve, UNI, etc.), but BSC has enough large projects including CAKEs and Venus. Yield Yak offers a comprehensive suite of tools including auto-compounding yield farms, a decentralized exchange (DEX) aggregator, and liquid staking solutions. Yield farming projects allow users to lock their cryptocurrency tokens for a set period to earn rewards for their tokens. Yield farms use smart contracts to.

Defi Pulse is a good place for you to track TVL. It provides an excellent overview of the current state of the yield farming market. Naturally, the greater the. Stablecoin yield farming is a variant of yield farming that involves utilizing stablecoins, which are cryptocurrencies pegged to a stable asset like the US. What is DeFi Yield Farming? · Liquidity Pool Liquidity pools refer to the pools of tokens or assets, which offer better returns to users than money markets. Yield farming involves putting cryptocurrency into a DeFi protocol to collect interest on trading fees. Liquidity providers can profit by. Yield farming is a high-risk investment strategy in which the investor provides liquidity, stakes, lends, or borrows cryptocurrency assets on a DeFi platform to. Yield farming with stablecoins is more stable than yield farming with volatile cryptocurrencies like Bitcoin and Ethereum. It also allows users to earn higher. Get the best farming development partner by working with our DeFi yield farming development services company. Stablecoin DevelopmentDeFi Yield Farming. In the event of avoiding troubles with cryptocurrency investment, stablecoins are considered the best place to start your investment pursuit. API-Powered stablecoin earnings for your fintech. Offer your customers the opportunity to earn on their stablecoins, seamlessly integrated through our API. Yield farming in the crypto space presents two primary variants: liquidity pool (LP) farms and staking farms. While both involve depositing cryptocurrency into. Submit your project to Alchemy's list of DeFi Yield Farming Platforms and we'll review it! Start building with web3's best Token API The first stablecoin to. Usually, stablecoin pools offer annual percentage yields (APYs) from 8% onwards. To optimize yield, you can opt to leverage farm stablecoins as. Yield farming is the process of earning rewards or interest by providing liquidity to a DeFi protocol. In the case of stablecoins, yield farming. Interest rates can reach 15%, and the top 50 cryptocurrencies are accepted. While Bitcoin might give up to % percent, rewards for holding stablecoins can. Top Yield Farming Tokens by Market Capitalization ; · $ % ; · $ %. Yield farming is the staking or lending of crypto assets in order to generate returns or rewards in the form of more cryptocurrency. The term Yield Farming was coined as a result of the process of actively searching for the best ROIs in the space whereby users, known as 'farmers', are on a. If you prioritize stability and predictability, the Stablecoin Yield Farming Pool is the best option. On the other hand, if you are willing to take on more. Therefore, leveraged yield farming is best used as a long-term strategy. If you farm a token pair with ETH and a non-stablecoin at 2x leverage (borrowing. Stablecoin yields give users crypto returns for holding various stablecoins and engaging in certain decentralized finance protocols. Yield farming your.

How Much Does Your Insurance Increase After A Dui

In any case, they farther away your DWI/DUI is (no difference to an insurance company if it's a DWI or DUI) the better insurance rating you will. If you are faced with DUI charges, talk to a Bergen County DWI Attorney and find out how they can help. What is a DUI? DUI stands for Driving Under the. I've been told if you get SR22 from an outside company and don't tell your main insurance provider, they probably won't find out. According to the Maryland Motor Vehicle Administration, a DUI conviction can lead to an average increase of 50% in your insurance rates. This increase can last. According to pantogormaz.ru, the average increase in New York car insurance rates following a DUI/DWI is 76%! However, New York State has laws restricting the amount. There are numerous long-term consequences of a DUI conviction. If you have been arrested for a DWI in Texas, expect your car insurance rates to climb by an. Your car insurance rates will likely increase after a DUI if you are convicted. Because the DUI (and points on your license) will make you a “high-risk” driver. A DUI or DWI offense can raise your car insurance rate by an average of 80 percent. · On average, the cheapest full-coverage car insurance for a driver with a. For insurers, a DUI, OWI or DWI conviction is among the most serious indicators of risky driving habits. For that reason, you can expect car insurance rates. In any case, they farther away your DWI/DUI is (no difference to an insurance company if it's a DWI or DUI) the better insurance rating you will. If you are faced with DUI charges, talk to a Bergen County DWI Attorney and find out how they can help. What is a DUI? DUI stands for Driving Under the. I've been told if you get SR22 from an outside company and don't tell your main insurance provider, they probably won't find out. According to the Maryland Motor Vehicle Administration, a DUI conviction can lead to an average increase of 50% in your insurance rates. This increase can last. According to pantogormaz.ru, the average increase in New York car insurance rates following a DUI/DWI is 76%! However, New York State has laws restricting the amount. There are numerous long-term consequences of a DUI conviction. If you have been arrested for a DWI in Texas, expect your car insurance rates to climb by an. Your car insurance rates will likely increase after a DUI if you are convicted. Because the DUI (and points on your license) will make you a “high-risk” driver. A DUI or DWI offense can raise your car insurance rate by an average of 80 percent. · On average, the cheapest full-coverage car insurance for a driver with a. For insurers, a DUI, OWI or DWI conviction is among the most serious indicators of risky driving habits. For that reason, you can expect car insurance rates.

On average, you can expect to pay no less than 30 percent more than you would pay with a clean driving record. How Long Does a DUI Stay on Your Insurance? A DUI. What are standard DUI penalties? The punishment for drunk driving in California depends on whether you have any prior DUIs in the year lookback period. If. At Progressive, you can likely still get insurance if you've had a DUI. Depending on the state, a DUI may be referred to as a DWI (driving while intoxicated). I've been told if you get SR22 from an outside company and don't tell your main insurance provider, they probably won't find out. Bit first year after getting a DUI your car insurance premiums go up on average %. That means if you pay $ a month for insurance a DUI. Existing Company: If your existing company were to learn of the DUI, the cost of the increase may be in the 30 to 50% range for the vehicles on. DUI attorneys are specialists who keep up with the latest laws and regulations in Georgia on drunk driving and DUIs. A reasonable DUI attorney will know the. Typically, DUI convictions do not lead to immediate rate increases for auto insurance. It's illegal for insurance companies to adjust your policy “mid-term” or. Note that a DUI conviction will not only impact your insurance rates directly. You can also lose bonuses that kept your insurance costs low. Your insurance. The state of North Carolina has an assigned risk pool (NC reinsurance facility), into which most insurance companies put “high risk” drivers with DUI/DWI. If you get a DUI, the cost of your car insurance will go up. On average, annual car insurance for DUI drivers increases by 67%, or $1, If you've recently. An insurance rate increase for drivers who have received a DUI charge is unavoidable. Premiums may, at minimum, double for those accused of a DUI. You can look. If you've been convicted of a DUI in Illinois, you can bet on one thing: your car insurance premium will increase. But just how much these rates will increase. According to pantogormaz.ru, the average increase in New York car insurance rates following a DUI/DWI is 76%! However, New York State has laws restricting the amount. In Louisiana, average annual premiums increase by 62% after a DUI conviction. For example, the average yearly cost of full coverage car insurance in Louisiana. Over 10 years, this increase can result in an additional $5, to $10, in insurance costs. How much will your insurance go up after a DUI? In Florida, a DUI. What Are DUI Insurance Rates? · DWI: Driving while impaired or intoxicated · OUI: Operating under the influence · OVI: Operating vehicle intoxicated · OMVI. "How Long Does a DUI/DWI Stay on Your Record?." Jamie Johnson. Jamie Johnson is a Kansas City-based personal. Insurance rates can increase by up to % after a first DUI, on average, depending on the state and insurance company. The best thing to do after a DUI is. After a DUI, insurance companies will raise the driver's premiums as much %, and maintain higher premiums for 5 years or more.

Family Mortgage Loan Agreements

Sign several legal documents that go along with the private home loan (more paperwork info below) · Make steady mortgage payments each month until the loan is. Even if you think you may not need a loan agreement with a friend or family member, it is always a good idea to have this in place just to make sure there. Today's interest-rate environment makes it easy to loan money to family members with full IRS approval. Here's a rundown of what the law covers. In some instances, less than two years of history may be acceptable when the applicant provides, and the Loan Originator documents sound justification. For. For a single-family residential development loan in which the project • the loan documents the loan agreement, mortgage, or deed of trust? • take. Yes, you can write a personal Loan Agreement between family members. It is important to follow contract formalities to hold both parties accountable. If there. protect the property from claims of the borrower's creditors or divorcing spouses; · benefit the lender if the borrower attempts to refinance the mortgage. family conventional first mortgages that are sold to when changes are made to the terms of a mortgage (such as the Loan Modification Agreement); or. Today's interest-rate environment makes it easy to loan money to family members on favorable terms with full IRS approval. Here's a rundown of what the law. Sign several legal documents that go along with the private home loan (more paperwork info below) · Make steady mortgage payments each month until the loan is. Even if you think you may not need a loan agreement with a friend or family member, it is always a good idea to have this in place just to make sure there. Today's interest-rate environment makes it easy to loan money to family members with full IRS approval. Here's a rundown of what the law covers. In some instances, less than two years of history may be acceptable when the applicant provides, and the Loan Originator documents sound justification. For. For a single-family residential development loan in which the project • the loan documents the loan agreement, mortgage, or deed of trust? • take. Yes, you can write a personal Loan Agreement between family members. It is important to follow contract formalities to hold both parties accountable. If there. protect the property from claims of the borrower's creditors or divorcing spouses; · benefit the lender if the borrower attempts to refinance the mortgage. family conventional first mortgages that are sold to when changes are made to the terms of a mortgage (such as the Loan Modification Agreement); or. Today's interest-rate environment makes it easy to loan money to family members on favorable terms with full IRS approval. Here's a rundown of what the law.

National Family Mortgage is the smart way to manage mortgage loans between family members, keeping wealth between you and your loved ones. A template of a Family Loan Agreement, an agreement made between a borrower that agrees to accept and repay money to a lender who is related by blood or. family residence by an appraiser approved by the Office of Loan Programs. Processing: The preparation of a mortgage loan application and supporting documents. Loan agreements should be used even when lending money to a friend or family member. Unlike a casual IOU, a formal contract makes every detail clear for. Promissory note. Also referred to as a mortgage note, this is a legally binding document signed by you, the borrower, saying that you promise to repay the loan. This is a simple loan agreement suitable for lending money to family or friends. It is intended to make clear to the borrower that the arrangement is for real. A personal loan agreement is a written contract between two parties, generally a borrower and a lender. It outlines how much money is being borrowed. The most important legal document for lending money to family members is a loan agreement. While a verbal agreement can be legally binding, it's difficult to. (10) "Lender" includes, but is not limited to, a mortgage broker originating a loan in a tablefunded loan transaction in which the broker is identified as the. Single-Family · About Us · Careers · Contact Us · Login. FM Site Nav. Homepage mortgage loan documents going forward. Multifamily Legal Guidelines: Review. After you have reviewed and approved your loan documents, the documents are emailed to the Borrower's settlement agent. The settlement agent will oversee. Whether you write it down or not, your agreement should answer the following questions: Who is providing what (money, time, services, or something else) to whom. Create a state and county approved Mortgage / Deed of Trust / Security Deed agreement — not just a promissory note. Record the Mortgage / Deed of Trust /. Sometimes a family loan might work in the interest of both parties. For instance, the borrower might receive a more favorable interest rate than they might have. Mortgage (revised 6/12/13). REVERSE. Notes, Mortgages, Agreements. HECM ARM Note (10/23); HECM ARM Second Note (10/23); HECM ARM Loan Agreement (10/23); HECM. Tip 2: Lay out all key loan agreement terms. · Names and addresses of the parties to the agreement. · Loan amount (principal). · Interest rate. · Repayment terms. While loaning money to family might seem like a good idea, if not properly executed, an intrafamily loan can lead to unexpected taxable income, gift tax, or. App for peer to peer lending and borrowing between family and friends. We help you legalize and manage a loan transaction. Our platform also helps you. A family loan agreement template is used when a family member wishes to borrow money from another member. This loan agreement between family members. A personal loan agreement is a contract between a lender and borrower spelling out the terms of a loan. Having one is usually a good idea whether you're.

Max In A Roth Ira

For example, for the tax year , a couple filing jointly and reporting less than $, in adjusted gross income may contribute the annual maximum of. Even if you can't do the max, consider increasing Individual Retirement Account (IRA) Limits. 20Traditional/Roth IRA contribution limits3. $, for all other individuals. Divide the result in (2) by $15, ($10, if filing a joint return, qualifying surviving spouse, or married filing a. Roth IRA contributions and limits. In , you can contribute up to $6, to a Roth IRA (or $7, if you'll be at least age 50 by year end. The Roth IRA contribution limit for is $7, in ($8, if age 50 or older). At certain incomes, the contribution amount is lowered until it is. IRA contribution rules · If you're under age 50, you can contribute up to $ · If you're age 50 or older, you can contribute up to $8, In , you can contribute a total of up to $, or $ if you're age 50 or older, to all of your Roth and traditional IRA accounts. Those that meet the Roth IRA income limits can make the max Roth IRA contribution, which is reviewed and adjusted annually. Currently, Roth contribution limits. The Roth IRA income limit to make a full contribution in is less than $, for single filers, and less than $, for those filing jointly. For example, for the tax year , a couple filing jointly and reporting less than $, in adjusted gross income may contribute the annual maximum of. Even if you can't do the max, consider increasing Individual Retirement Account (IRA) Limits. 20Traditional/Roth IRA contribution limits3. $, for all other individuals. Divide the result in (2) by $15, ($10, if filing a joint return, qualifying surviving spouse, or married filing a. Roth IRA contributions and limits. In , you can contribute up to $6, to a Roth IRA (or $7, if you'll be at least age 50 by year end. The Roth IRA contribution limit for is $7, in ($8, if age 50 or older). At certain incomes, the contribution amount is lowered until it is. IRA contribution rules · If you're under age 50, you can contribute up to $ · If you're age 50 or older, you can contribute up to $8, In , you can contribute a total of up to $, or $ if you're age 50 or older, to all of your Roth and traditional IRA accounts. Those that meet the Roth IRA income limits can make the max Roth IRA contribution, which is reviewed and adjusted annually. Currently, Roth contribution limits. The Roth IRA income limit to make a full contribution in is less than $, for single filers, and less than $, for those filing jointly.

Limit on after tax contributions: 10% of participant's maximum recognizable compensation for all years of participation in the retirement plan. * Age 50 and. A Roth IRA conversion occurs when you take savings from a Traditional, SEP or SIMPLE IRA, or qualified employer-sponsored retirement plan (QRP), such as a In , the contribution limits are $7, per year to a Roth IRA (and $8, per year when you are age 50 or older). To determine how much money you can. A Roth IRA is a special type of retirement account that allows your monetary contributions and interest earnings to grow tax free. As long as you have some income and do not exceed the MAGI limits, you can contribute whether you are 16 or For , the total maximum contributions you can make across all of your traditional (pre-tax) IRAs and Roth IRAs is $7, If you are over the age of The limit for contributions to traditional and Roth IRAs for is $, plus an additional $ if the taxpayer is age 50 or older. Roth IRA Limits for Highlights. Like a traditional IRA, the maximum amount you can contribute for those under 50 is $6, Those 50 and older can. For , the maximum contribution to all your Roth and Traditional IRAs for individuals under 50 years old is $6, For individuals 50 and over, the maximum. Calculate your IRA contribution limits. When it comes to IRAs, your age, income and filing status all have a say in how much you can tuck away. If you're a married couple filing jointly, you can contribute up to the maximum amount to each spouse's IRA if your combined MAGI is under $, for As. For , the maximum annual IRA contribution is $7, which is a $ increase from It is important to note that this is the maximum total contributed. Also, there is an aggregate lifetime limit of $35, on such rollover distributions with respect to the designated beneficiary. The rollover distribution. For , the upper limit for a contribution to a Roth IRA reaches $, for certain filers, to account for inflation and increasing wages. Roth IRA. The maximum amount you can contribute to a Roth IRA for is $7, (up from $6, in ) if you're younger than age If you're age 50 and older, you. For Roth IRA and Traditional IRA the maximum is $6, If you are over 50 years of age you can contribute $1, more (total of $7,). For a SEP IRA, the. $6,; or; Your taxable compensation for the year. If you will be age 50 or over in , the most that you can contribute to your Roth NYCE IRA will be the. For example, if you make $10, in pre-tax Plan account contributions, you can also make up to $9, in Roth (b) after-tax contributions. Employees who are. Total annual contributions to a Traditional IRA, Roth IRA, or both cannot be more than the annual maximum for your age or % of earned income, whichever is.

Turbotax W 9 Form

Displaying 1 - 15 of results. Individual Income Tax. Form Form IA A pantogormaz.ru pantogormaz.ru November 29, Tax Returns that are received by the Department of Finance and are NOT registered will be returned to the taxpayer along with a registration form. Tax payments. A W-9 form is an Internal Revenue Service (IRS) tax form that is used to confirm a person's name, address, and taxpayer identification number (TIN). Consent to receive your W-2/S, and/or C Online - Employees who would like to consent for electronic distribution of their tax statement(s), must do so. RTS-9, Reemployment Tax Application for Agent Registration. PDF Icon PDF (81KB) Specific Fuel Tax Forms. Form #, Description, Form Options. DR Idalia. Withholding Tax Tables ; Form Name South Carolina Employee's Withholding Allowance Certificate - , Form NumberSC W-4 ; Form NameSouth Carolina. appropriate Form W See Pub ,. Withholding of Tax on Nonresident Aliens and. Foreign Corporations. What is backup withholding? Persons making certain. The W-2 form reports taxable income and corresponding withholdings for paychecks issued between January 1 and December 31 of each year. POPULAR FORMS & INSTRUCTIONS; Form · Form Instructions · Form W-9 · Form T · Form W-4 · Form · Form W-2 · Form ; POPULAR FOR TAX PROS. Displaying 1 - 15 of results. Individual Income Tax. Form Form IA A pantogormaz.ru pantogormaz.ru November 29, Tax Returns that are received by the Department of Finance and are NOT registered will be returned to the taxpayer along with a registration form. Tax payments. A W-9 form is an Internal Revenue Service (IRS) tax form that is used to confirm a person's name, address, and taxpayer identification number (TIN). Consent to receive your W-2/S, and/or C Online - Employees who would like to consent for electronic distribution of their tax statement(s), must do so. RTS-9, Reemployment Tax Application for Agent Registration. PDF Icon PDF (81KB) Specific Fuel Tax Forms. Form #, Description, Form Options. DR Idalia. Withholding Tax Tables ; Form Name South Carolina Employee's Withholding Allowance Certificate - , Form NumberSC W-4 ; Form NameSouth Carolina. appropriate Form W See Pub ,. Withholding of Tax on Nonresident Aliens and. Foreign Corporations. What is backup withholding? Persons making certain. The W-2 form reports taxable income and corresponding withholdings for paychecks issued between January 1 and December 31 of each year. POPULAR FORMS & INSTRUCTIONS; Form · Form Instructions · Form W-9 · Form T · Form W-4 · Form · Form W-2 · Form ; POPULAR FOR TAX PROS.

W, "Report of Tax Year Water Utility Company Assets"); See form for instructions. Vendor Forms. All forms are fillable and printable unless a separate. For purposes of payment, the University must request Form W-9 to certify a Taxpayer Identification Number (TIN) or Federal Employer Number (FEIN) and other. Form W-9 · Form T · Form W-4 · Form · Form W-2 · Form ; POPULAR FOR TAX We're currently processing forms we received during the months shown. Note: International Employees may receive a W-2 and a S. Please wait until you have received all tax forms to file your US tax return NR. Note: Request. The W-9 is an Internal Revenue Service (IRS) form in which a taxpayer provides their correct taxpayer identification number (TIN) to an individual or entity. Form RD is a tax return used by a resident individual taxpayer or a non-resident working in Kansas City, Missouri to file and pay the earnings tax of one. Find the W-8 and W-9 IRS tax forms that Wells Fargo Corporate & Investment Banking must receive from clients. Information about Form , U.S. Corporation Income Tax Return, including recent updates, related forms and instructions on how to file. Use this form to. Find out how to get your form. Follow these instructions to find and download your form. · Get IRS Form W-4 · Set up Federal Tax Withholding (W-4P. Form, Current, , Jun 1, TCPR, TCPR, Application for Refund of Utah Sales and Use Tax, , Sep 9, , Sales, Form, Current. TC-. File this form to report gambling winnings and any federal income tax withheld on those winnings. The requirements for reporting and withholding depend on. Instructions: Enter a full or partial form number or description into the 'Title or Number' box, optionally select a tax year and type from the drop-downs. A W9 form is an IRS form used to provide a person's Tax Identification Number (TIN) to their payer (or whomever is responsible for filing an information return. Fiduciary Income Tax Return. Complete Online Complete, save and print the form online using your browser. X Amended Fiduciary Income. Indiana Full-Year Residents. Federal forms such as Form and W-4 can be found on the IRS website. Name, State Form Number. Quarterly reconciliations are neither required nor accepted. The annual form, accompanied by copies of Forms W-2, is due on or before the last day of January of. This form reports your wage earnings if you worked. If you had more than one employer you should get a W-2 from each employer. It is issued by the end of. Supported federal forms · Wages and salaries (Form W-2) · IRA and pension distributions (Form R) · Interest and dividend income (Form INT and Form To expedite the processing of your tax returns, please file electronically or use our preprinted forms whenever possible. Emergency Communications Forms. Active-duty and Reserve officers: You can file free federal tax returns with TurboTax Online Deluxe. Simply use your military W-2 and verify your rank. This.

1 2 3 4 5 6